Demystifying the Zerodha Brokerage Calculator: A Comprehensive Guide

Introduction: Understanding Brokerage Costs and Maximizing Your Returns

Investing in the stock market can be exciting but can come with costs. One of these costs is brokerage fees. Knowing how to calculate these fees can help you maximize your returns. Zerodha, a well-known brokerage in India, offers a handy tool called the Zerodha Brokerage Calculator. This tool makes it easy to understand your costs before making any trades.

Exploring the Zerodha Brokerage Calculator: Features and Functionality

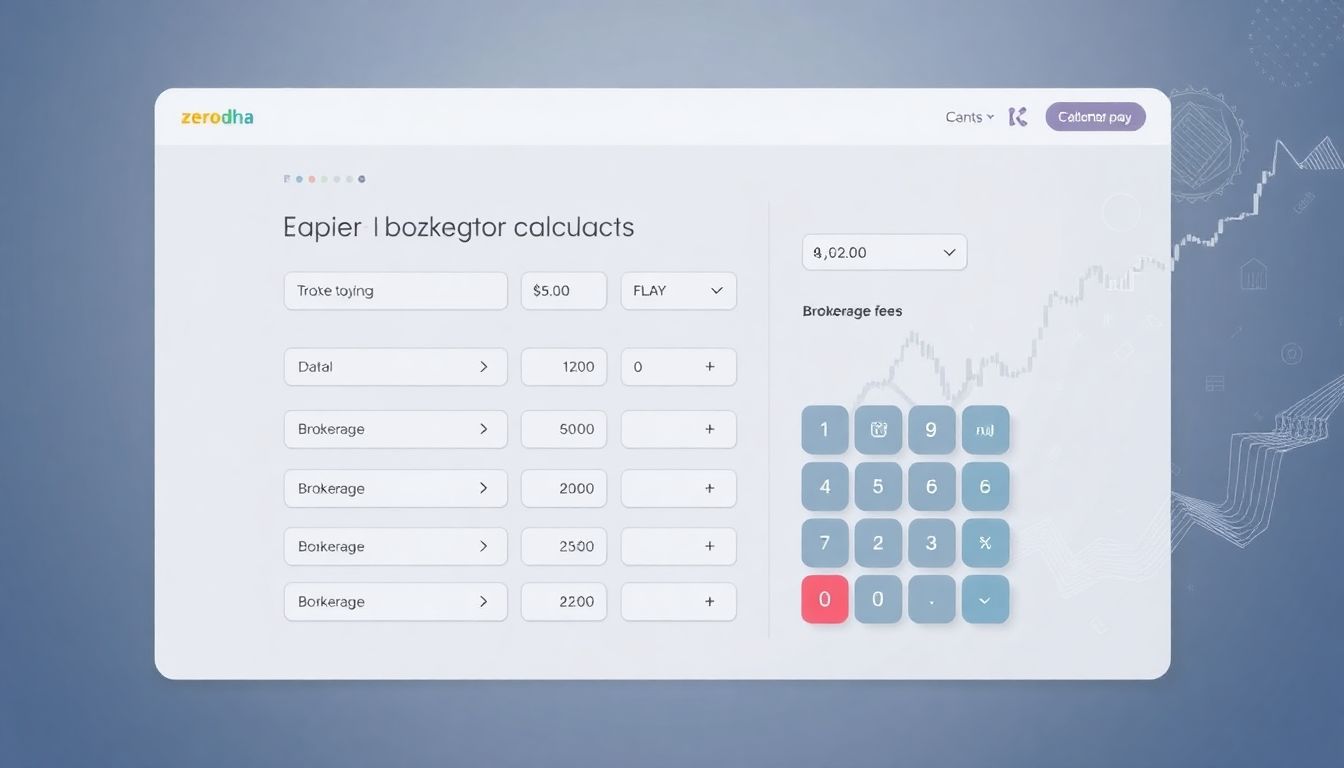

Navigating the Calculator Interface: A Step-by-Step Guide

Using the Zerodha Brokerage Calculator is simple. Here’s how you can get started:

- Access the Calculator: Visit the Zerodha website and find the Brokerage Calculator.

- Choose the Segment: Select whether you’re trading in stocks, futures, options, or commodities.

- Input Trade Details: Enter the number of shares or contracts, the price per share, and any other required information.

- Calculate: Hit the calculate button to get a detailed breakdown of the charges.

Understanding the Different Charges: Brokerage, Taxes, and Other Fees

When you use the calculator, you’ll see different charges. Here’s a breakdown:

- Brokerage Fee: The fee charged by Zerodha per trade.

- Securities Transaction Tax (STT): A tax on the purchase and sale of equities.

- Goods and Services Tax (GST): A tax on brokerage services.

- Stamp Duty: A state-specific tax on each transaction.

- Exchange Transaction Charges: Charges levied by the stock exchange.

Inputting Trade Details for Accurate Calculations

Be precise when entering your trade details. Accurate inputs lead to accurate outputs. For instance, if buying 100 shares at ₹200, enter “100” as the quantity and “200” as the price. This clarity ensures the calculator reflects true costs.

Calculating Brokerage for Different Trading Segments

Equity Delivery: Understanding Brokerage Charges for Delivery-Based Trades

In equity delivery, you buy shares and hold them. The brokerage fee is typically higher here compared to intraday trading. Zerodha charges a flat fee of ₹20 or 0.1% of the trade value, whichever is lower.

Intraday Trading: Calculating Brokerage for Intraday Equity and F&O Trades

For intraday trading, the cost structure changes. You can benefit from lower brokerage fees. Still, you need to be aware of the risks involved when holding shares for only a day. The calculator adjusts the fees accordingly, helping you make informed decisions quickly.

Commodity and Currency Derivatives: Brokerage Structure for Derivatives

When trading in commodities or currency derivatives, the brokerage rates remain the same at Zerodha. Understanding these fees is vital, especially if you want to diversify your portfolio.

Optimizing Your Trading Strategy Using the Brokerage Calculator

Minimizing Brokerage Costs Through Strategic Trading

You can reduce your brokerage fees by planning your trades. For example, trading in large quantities helps lower the per-unit cost of brokerage.

Comparing Zerodha's Brokerage with Other Brokers

Use the calculator to see how Zerodha’s fees stack up against other brokers in the market. This comparison can guide you in selecting the right broker for your needs.

Utilizing the Calculator for Long-Term Investment Planning

The brokerage calculator is not just for quick trades. It helps you see potential long-term costs too. By calculating fees over several trades, you can plan your investments better.

Advanced Features and Tips for Efficient Use

Utilizing the Calculator for Backtesting Trading Strategies

The calculator is also useful for backtesting. Enter historical trade data to see how fees would have impacted past performance, enabling smarter future trades.

Understanding the Impact of Transaction Charges on Overall Returns

Transaction fees can eat into your profits. The calculator allows you to see these impacts up front, helping you decide whether a trade is worth it.

Accessing and Interpreting Detailed Transaction Reports

Zerodha provides transaction reports that can be accessed once trades are executed. Understanding these reports in conjunction with the calculator helps you track your expenses over time.

Conclusion: Mastering the Zerodha Brokerage Calculator for Informed Trading

Using the Zerodha Brokerage Calculator can significantly enhance your trading experience.

Key Takeaways: Effective Brokerage Management for Success

- Always calculate your brokerage fees before making trades.

- Understand different charges: brokerage, taxes, and fees.

- Regularly use the calculator for a strategic approach to investing.

Actionable Steps for Using the Calculator to its Full Potential

- Use the calculator for each trade.

- Monitor your overall transaction costs.

- Compare Zerodha with other platforms regularly.

Resources for Further Learning on Brokerage and Investment Strategies

Explore Zerodha’s educational content and webinars. There are also numerous online platforms where you can learn more about effective trading and investment strategies.

Using these tools can help you achieve financial success through smart trading decisions.